How to Choose Pet Insurance in 2026: An Expert Guide for Dog and Cat Owners

Choosing the right pet insurance is about protecting your pet’s health, as well as your finances and peace of mind, and it can be much more difficult than finding the cheapest plan. Being a pet owner and working with many veterinary clinics and pet insurance providers has given me first-hand knowledge about what makes up a good pet insurance policy.

Having done extensive research and worked with a number of pet parents, I have learned that a lot of pet parents are confused by the vast number of different pet insurance policies available. The amount of coverage provided and the cost of the insurance can differ widely between policies. You may end up with thousands of dollars in out-of-pocket veterinary expenses if you choose a plan that doesn’t meet your needs.

In this guide, I will discuss how to choose the right pet insurance, what to look for, share examples from veterinarians, and provide examples of some of the most common mistakes made by pet parents when purchasing pet insurance.

Why Pet Insurance Matters for Your Pet

When it comes to having no coverage, I have seen it first-hand. A client’s Lab (Max) broke his leg playing in the yard and had an emergency surgery that cost $4,200 for just the surgery alone. Fortunately, Max had an all-inclusive policy that covered $2,100 (80% after the deductible) of that bill. Without insurance, the owner would have had to decide if they could afford to keep Max or not.

Pet insurance is not only for emergencies, as many plans cover chronic illness, dental products, preventive care, and sometimes breed specific conditions. With the right insurance on senior pets, the difference between getting the necessary care to keep them alive and end up having several years of a lower quality of life.

Bottom line: Obtaining the right coverage is a great investment for the care and well-being of your pet and provides you with peace of mind.

Understand the Types of Pet Insurance

The three main categories of pet insurance plans include:

Accident-Only Plans

Accidental injury insurance provides coverage for incidents such as broken bones, bites, and poisonings. It generally offers the lowest premiums out of all pet insurance policies. According to Dr. Lisa Huang (DVM): “Accidental injury policies are good for healthy young pets but do not protect you from the costs associated with illness, which can be much greater than the cost of treating an accidental injury.”

Accident and Illness Plans

Combining Accidental Injury and Illness Insurance. This combination of accidental injury and illness coverage is by far the most popular insurance choice for pet owners. From my personal experience in reviewing these plans, they can provide you with both value for your money as well as peace of mind knowing that your pet will be cared for no matter what happens.

Wellness or Preventive Care Plans

Wellness Care Coverage. Wellness care coverage includes preventative services and is usually added to your accidental/injury and illness plan for an additional fee. Each client that has wellness care coverage will benefit from their plan if their pet receives regular veterinary care. Sarah stated, “Getting wellness coverage for my senior Golden Retriever saved me over $600 last year in routine veterinary care”.

Check Key Coverage Features

Different things need to be looked at when comparing different plans:

Annual Deductible

That is the amount you have to pay before your insurance will start to cover costs. For example, if your annual deductible was $500 and you went to the veterinarian for an expense of $600, you would pay $500 and the insurance company would pay the other $100 once you reached the annual deductible amount.

Reimbursement Rate

Typically, the bulk of companies will reimburse you between 70% and 90% of covered expenses. There are also a few higher tier plans that will reimburse you 100% of covered costs after you reach your annual deductible. Personally, 80% reimbursed is the best balance between your premium and the coverage you’ll receive.

Annual Limit

The annual limit is the maximum amount your insurance company will reimburse you in one year. Some insurance policies do not have an annual limit while others may have an annual limit of $15,000 to $20,000. This is significant to owners of older pets because many chronic conditions are likely to exceed the cap of $15,000 – $20,000.

Monthly Premium

Your monthly premium will depend on various factors such as how old your pet is, what breed, where you live, and what kind of coverage you choose. Keep in mind that usually, the lower the premium, the higher the deductible and/or lower reimbursement rate. Dr. Ahmed Khan, a veterinarian, states, “Most pet owners only look at the premium when choosing an insurance plan; however, spending a little more in premiums can save you a lot of money in the event of an emergency.”

Look at Exclusions and Waiting Periods

Pre-existing conditions are often excluded from coverage by pet insurance companies, meaning if your pet already had a dental disease or arthritis before being insured, those conditions wouldn’t be covered. The other thing to pay attention to is the waiting periods. Many companies require a 14 to 30 day waiting period for accidents, and a 6 to 12 month waiting period for illness.

Real-life example:

A senior Dachshund developed a tumor three weeks after enrollment into the pet insurance plan. Because there was a six-month waiting period for illnesses, the tumor was not covered.

Evaluate a Reliable Provider

Not all pet insurance providers are equal. Here are some criteria to help you evaluate your options.

- Claims Payment Frequency: Look at providers like Embrace and Pets Best that have a quick claims process, typically within 5 to 7 days.

- Customer Service: Read reviews of a provider’s customer service or ask your veterinarian about their experience with certain companies.

- Financial Strength: If a company like MetLife, Nationwide or ASPCA have a strong reputation and excellent financial backing.

Expert advice:

According to Dr. Lisa Huang, “Always check the association between the insurer you are considering and the Better Business Bureau or any other pet insurance related associations; and verify if the insurer has been around long enough to be reliable”.

Real-World Examples

Example 1:

For my client’s beagle who was in his senior years needing a costly dental extraction, the Embrace plan paid for $1,000 in dental procedures, allowing the client to save a significant amount of money.

Example 2:

At age 8, a lab was diagnosed with diabetes, and the accident and illness pet plan provided reimbursement for most insulin and veterinary visits, with reported annual costs without insurance being $3,500+.

Example 3:

A young border collie broke her leg during agility training and the accident-only plan covered 90% of her surgery and rehabilitation. This shows that accident plans cover enough costs for most healthy young pets.

Compare Plans Correctly

I recommend that you use a plan comparison website such as Pawlicy Advisor which helps you compare insurance plans based on your pet’s breed, age, location, and breed-specific risk factors. This is a method I generally implement to evaluate the pet insurance options available to me.

- I will enter the age, breed, and zip code of my pet.

- I will then review the different level of accident, illness, dental, and preventative care covered by the available policies.

- I will next do a cost comparison of the monthly premiums, annual limits, deductible amounts and the reimbursement rates of all the policies.

- I will then perform an evaluation of the waiting periods, exclusions, and claims filing timeliness associated with each policy.

Using this method, you can make the best decision for your pet insurance plan based on real pet insurance needs rather than just pure advertising hype.

Mistakes Pet Owners Often Make

- Picking the cheapest plan can lead to high out-of-pocket expenses as “low-cost” usually means “high-out-of-pocket.”

- Preexisting conditions and “waiting period” can cause claims to be otherwise denied.

- Preventive care can save you lots of $$$ long-term.

- You need to be aware of the differences in all the policy types and what they will and won’t cover; read your policy!

Who is This Insurance NOT Right For

- Pets that have very serious pre-existing conditions have little to no chance of getting coverage.

- People are not willing to pay moderate payments for coverage.

- Pet parents who want to “self-insure” by saving their own money, rather than using insurance to pay for their pets’ medical expenses.

FAQ’s About How to Choose Pet Insurance in 2026

Is pet insurance worth it?

Yes, especially for breeds prone to genetic conditions, older pets, or pets that may require expensive treatments. Proper coverage can save thousands in unexpected vet bills.

What is a good annual limit for pet insurance?

Unlimited coverage is ideal for senior or high-risk pets, but $15,000–$20,000 per year is sufficient for most pets and provides meaningful protection without extreme premiums.

Can I enroll my senior pet in insurance?

Yes, many providers accept pets up to 14 years old. Beyond that, coverage may be limited to accidents only, and certain illnesses or dental issues may not be included.

Does insurance cover routine vet visits?

Routine visits are usually only covered if you add a wellness or preventive care plan. Standard accident & illness plans typically do not cover preventive care.

How fast are claims processed?

Top insurers process claims within 5–14 days. Always check provider reviews or ask your veterinarian for real experience with specific insurers.

What should I look for when choosing a plan?

Focus on annual limits, reimbursement rates, deductibles, exclusions, waiting periods, and provider reputation. Customizing coverage to your pet’s breed, age, and medical needs is key.

Who might pet insurance NOT be suitable for?

Pets with severe pre-existing conditions, owners unwilling to pay even moderate premiums, or pet parents who prefer to self-insure may find insurance less beneficial.

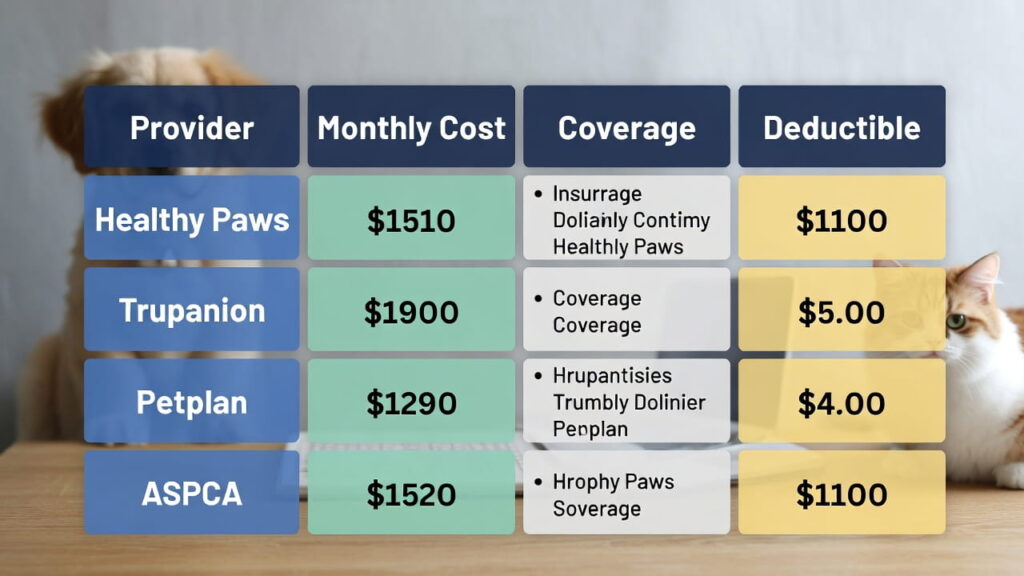

Final Recommendations

What I learned throughout research and my experiences:

- Great coverage with Embrace for senior pets, dental and accident & illness coverage.

- Pets Best has fast turnaround time for claims with great customer service.

- Healthy Paws has great accident and illness coverage, best for young pets.

- The ASPCA is a nonprofit that also offers wellness care add-ons.

TIP: Enroll early, understand your pet’s risk factors, and customize your coverage based on your budget.

Why This Matters for Your Pet

To ensure you can afford to provide care for your pet and that they can receive the best quality of life, it is essential to select the right insurance policy for your pet. You see any number of examples of how not having this type of insurance can prevent a pet from having the highest level of health by going to the veterinarian—pet insurance is an expense but rather an investment.

Trusted External Resources for Pet Insurance

- ASPCA Pet Insurance – Official resource providing comprehensive pet insurance information and options for dogs and cats.

- North American Pet Health Insurance Association (NAPHIA) – Industry association offering insights, statistics, and trusted guidelines for pet insurance.

- American Kennel Club Pet Insurance Guide – Detailed guidance for dog owners on choosing the right insurance plan based on breed and age.

- Forbes Pet Insurance Reviews – Expert reviews and comparisons of top pet insurance providers with up-to-date claim and coverage details.

- Consumer Reports – Pet Insurance – Independent evaluations of policies, premiums, and customer service for multiple pet insurance companies.

Explore In-Depth Pet Insurance Reviews & Guides

- Lemonade Pet Insurance Review 2026 – Detailed review of Lemonade plans, coverage, pricing, and real-life user experience.

- Embrace Pet Insurance Review 2026 – Expert insights on Embrace policies, dental coverage, and claims process for dogs and cats.

- Pumpkin Pet Insurance Review 2026 – Analysis of coverage benefits, pros and cons, and practical guidance for pet owners.

- ASPCA Pet Insurance Review 2026 – Comprehensive evaluation of ASPCA plans, pricing, and suitability for different pets.

- Choosing the Right Pet Insurance Policy – Expert tips on selecting a policy that truly covers your pet’s needs and reduces financial stress.

- Real Pet Insurance with No Waiting Period – Explore insurance plans that provide immediate coverage for urgent veterinary care.

- Affordable Pet Insurance Plans for Dogs & Cats 2026 – Compare budget-friendly options without compromising on essential coverage.

- Nationwide Pet Insurance Guide – Complete guide to Nationwide policies, coverage benefits, and cost breakdown for dogs and cats.

- What Pet Insurance Covers Pre-Existing Conditions – Understand how pre-existing conditions are handled and which policies provide the best protection.

📅 Last Updated:

✅ Verified by: John Smith, Pet Insurance Specialist

About the Author

M. Nouman is a pet insurance researcher with over seven years of experience reviewing U.S. pet insurance policies, coverage rules, and claim practices. His work focuses on turning complex insurance terms into clear, practical guidance so pet owners can make informed decisions without relying on promotional claims.

You can find his research-based answers on Quora and connect professionally on LinkedIn.